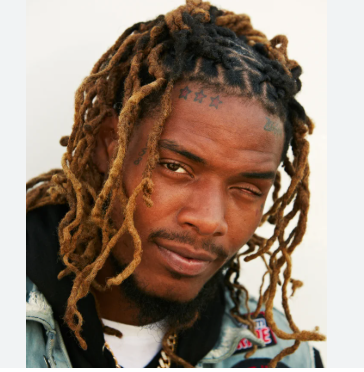

Let me introduce you to Alex Turner. Millennial husband. Father. Self made millionaire with his eyes on multi millionaire status. Alex is one of those rare money guys who actually knows how to explain finances without talking down to you or acting like everyone has a trust fund hiding somewhere.

What he does is simple but not easy. He helps everyday people get control of their money with a clear step by step plan. Budgeting that makes sense. Debt payoff that actually works. Credit scores that rise instead of haunt you. Savings and investing systems that stick longer than a New Year’s resolution. His whole mission is to help people stop living paycheck to paycheck and finally feel confident about their financial future. No smoke. No shame. Just structure, accountability, and mindset shifts that turn financial anxiety into a real plan anyone can follow.

But Alex did not wake up rich and enlightened.

Back in 2015, he was broke broke. A twenty something bachelor in New York City living a lifestyle his bank account absolutely could not support. Fancy car he could not afford. Five figure student loan debt. Manhattan rent on a retail salary. Credit cards maxed. Overdraft fees piling up. And a smile on his face pretending everything was fine. It was not fine.

He did not even know what net worth meant back then, but trust me, it was deep in the red. What hurt most was the hopelessness. No plan. No financial education. No examples of debt free people or happy retirees around him. Just normalized struggle dressed up as ambition.

The real wake up call came during a visit home when his mother told him his parents were divorcing. In that moment, all he wanted to do was help her financially. And he could not. He was too broke to help himself, let alone rescue anyone else. That hit his ego hard. But it also lit a fire. He realized he had no choice but to get serious about his money. That day, his financial journey officially began.

Now, as a financial coach, Alex will tell you the hardest part of the job is not the math. It is the mindset. Getting people to actually start. To stay consistent when life gets chaotic. To break emotional spending habits and money shame cycles. To be honest about income, debt, and priorities. And to trust the process long enough to see real results.

And yes, he has worked with some big names. One major highlight includes working with two New York City Council Members, including Council Member Kevin C. Riley. Together, they strengthened money communication within his household, created and followed through on a debt payoff plan, built an emergency fund, eliminated credit card debt, paid off a family car, and set up investments focused on his children’s future.

But what Alex is most proud of is not who he works with. It is what changes. Less stress. Better decisions. Clear structure. A real plan that protects families and builds long term wealth.

What keeps him going is impact. Helping people who feel like they are carrying the weight of building wealth for the first time finally feel capable and empowered. He wants people to know they can change their money story. And he lives that mission at home too, building security and freedom for his own family.

Ultimately, Alex wants to bring financial literacy to communities that have been denied access to it for far too long. He wants to build something that lasts beyond him. A legacy rooted in the belief that access to knowledge can change lives and generations forever.

And honestly, that is a message worth delivering. Even if I am just shooting the messenger.

Leave a Reply