Many families across the nation feel like they are running on a financial treadmill just to stay in place. Despite working hard, bank accounts seem to dwindle faster than ever before. The American Dream feels increasingly out of reach for the average citizen as daily expenses climb relentlessly unabated.

The most significant drain on household income often comes from essential needs that have become unaffordable. For instance, housing costs have skyrocketed, consuming a massive portion of monthly paychecks for renters and buyers alike. Furthermore, healthcare expenses continue to rise, leaving many families terrified of a single unexpected medical emergency. Similarly, the massive burden of student loan debt cripples young professionals before they even start their careers.

While costs soar, incomes have largely remained flat in real terms for decades. Stagnant wages mean that a standard paycheck simply doesn’t stretch as far as it used to. Consequently, inflation acts as a hidden tax on everyone, constantly eroding purchasing power. We also see significant “shrinkflation” at the grocery store, where we pay the same price for smaller product quantities.

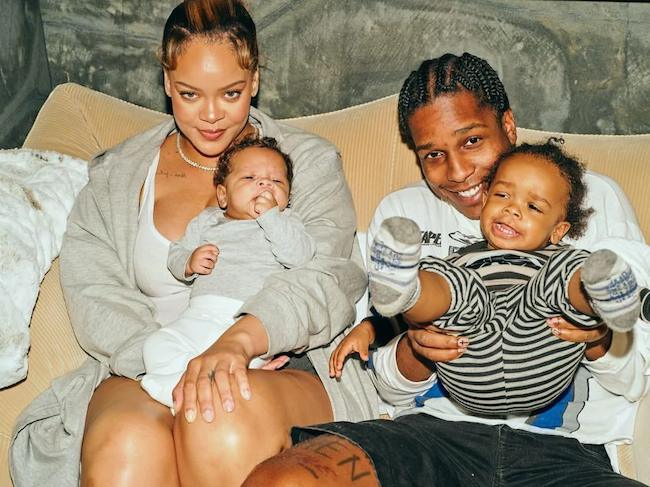

Raising a family presents another set of steep financial hurdles in the modern economy. Childcare costs often rival rent payments in many high-cost areas of the country. Additionally, rising insurance premiums for cars and homes add insult to financial injury. Even basic grocery bills have become a major source of weekly stress for countless households.

Many people turn to high-interest credit cards just to bridge the gap, leading to spiraling consumer debt. This cycle is often exacerbated by a general lack of fundamental financial literacy taught in schools. Moreover, the modern gig economy rarely offers the stability or benefits of traditional employment, leaving workers vulnerable. For a deeper dive into these systemic issues, this video explores the complex reality of the situation:

Finally, unexpected emergency expenses can wipe out meager savings accounts instantly. Many consumers also fall victim to lifestyle creep, trying to maintain an image they cannot actually afford. Furthermore, we are facing higher taxes in various forms that slice away at take-home pay. To combat these headwinds, it is crucial to utilize resources like Investopedia’s guide to budgeting to regain some control.

Leave a Reply